S important to contemplate not only the NPV but in addition different factors similar to risk, market situations, and different opportunities. A optimistic NPV signifies that the funding is predicted to generate more wealth than it prices net present value npv what it means and steps to, while a adverse NPV suggests the other. Therefore, relying solely on NPV without contemplating these extra elements could lead to suboptimal funding choices. The break-even internet current value (NPV) is a vital concept in funding analysis, representing the purpose at which the present worth of cash inflows equals the current worth of cash outflows.

Cash flows symbolize the money that will be generated or spent over the lifetime of the investment, typically together with revenues, operating prices, and any further expenses. It’s essential to estimate these money flows precisely to ensure a dependable NPV calculation. An NPV higher than zero signifies that the investment is predicted to generate more value than its price, making it a potentially good funding choice. Conversely, a negative NPV means that the funding could not meet the desired return, signaling that it may not be value pursuing.

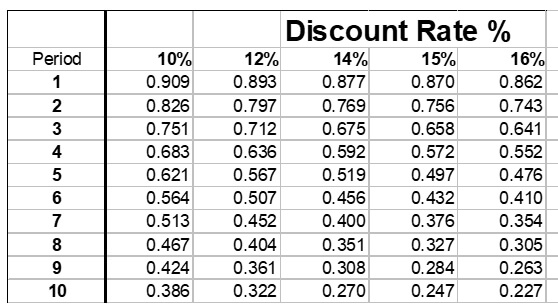

Calculating the present worth of cash outflows is a crucial step in determining the web present value (NPV) of an investment. Money outflows usually embody initial investments, working costs, and any other bills incurred over the investment’s life. These cash flows need to be discounted to reflect their value at present, utilizing a specific low cost price. Lastly, subtract the preliminary investment cost from the total present worth of the money inflows to arrive at the NPV. If the NPV is constructive, it signifies that the funding is predicted to generate extra worth than its price, making it a doubtlessly worthwhile funding.

- The web current worth is the sum of all an investment’s discounted deposits and payouts this current day.

- Learning about the method to calculate internet present worth and its advantages is essential for businesses when assessing upcoming tasks.

- With cautious consideration of assumptions and dangers, it may be a useful approach to make funding decisions.

- Exploring further sources and seeking skilled advice can present a more comprehensive understanding of this important monetary idea.

- As Soon As the present values of all future cash inflows are calculated, they are summed collectively to get the whole current value of cash inflows.

Npv Capabilities In Excel

One major drawback of calculating NPV is that it makes assumptions about future occasions. The web capital value methodology assumes a highly simplified capital market – among other things, the equalization of debit and credit interest. As a consequence, it is an indicator that can not be readily transferred to real circumstances. The calculation of the NPV is predicated on the discounting of all deposits and payouts brought on by the actual investment. For the payout, the funding sum in its complete quantity is factored into the calculation of the net present worth as a unfavorable quantity.

As mentioned, net present worth just isn’t particular to investing in shares or other securities. Businesses can also use net present worth formulas to find out where to allocate their capital. For instance, if a retail store is considering of opening a brand new location, a net present worth evaluation can shed some mild on whether or not the project is value endeavor. Discover out the NPV and conclude whether it is a worthy funding for Hills Ltd.

This step-by-step approach aims to enhance understanding and facilitate the calculation of NPV for varied investments. As we note below that Alibaba will generate a predictable constructive Free Money Flows. A optimistic NPV indicates a doubtlessly viable funding, because it means that the project will generate extra worth than its price. The second term represents the primary cash move, maybe for the primary year, and it might be unfavorable if the project is not worthwhile in the first year of operations. The third time period represents the money move for the second year, and so forth, for the number of projected years.

Accounts That Earn Compounding Curiosity

If, for example, the capital required for Project A can earn 5% elsewhere, use this discount rate in the NPV calculation to permit a direct comparison to be made between Project A and the alternative. Re-investment rate could be outlined as the rate of return for the firm’s investments on average. When analyzing projects in a capital constrained surroundings, it may be appropriate to use the reinvestment fee somewhat than the firm’s weighted common cost of capital because the low cost factor. It reflects alternative value of investment, rather than the presumably lower value of capital. A agency’s weighted average value of capital (after tax) is usually used, however many individuals believe that it is applicable to make use of larger low cost rates to adjust for danger, opportunity price, or other elements.

To effectively use the NPV formula, one should estimate future money flows generated by the funding. These money flows are then discounted again to their current value using the chosen discount fee, which displays the danger and alternative value of capital. By summing these discounted cash flows and subtracting the initial investment, traders can determine the NPV. The strategy of calculating NPV entails discounting future money flows back to their current value using a specified low cost rate. This technique accounts for the reality that cash obtainable right now is value more than the same quantity sooner or later due to its potential earning capacity.

And that’s a predisposition for the people involved within the project to believe in it. They really feel excited to construct that new engineering plant or purchase cutting-edge gear. As a end result, the passion of people estimating investment returns could typically have an result on their judgment and underlying assumptions. As A Outcome Of these individuals are too close to the entire project, they’re prone to https://www.personal-accounting.org/ taking an optimistic strategy to assessing future cash flows.

A larger prevailing rate of interest usually ends in the next discount rate, reflecting the elevated cost of capital for traders. Internet Current Value (NPV) is a vital tool for traders and financiers to judge projects, investments, or company securities based mostly on their precise worth in today’s dollars. To understand NPV, it’s essential to grasp the idea of current worth, discounted cash move, and the connection between them.

In the case of capital investments, the money flows come in the type of revenues and prices. For our investment example, we calculate the money flows for four years while considering all anticipated deposits and payouts. The time value of money is taken into account in both methods, but their software and interpretation differ.