Even larger companies can leverage its integration capabilities inside their present financial techniques. It’s a device for all seasons, a silent associate in the often-solitary journey of entrepreneurship. All QuickBooks Enterprise plan customers pay a further payment for contractors paid via direct deposit. QuickBooks Enterprise Diamond users will pay just $1/employee per month underneath the Assisted Payroll plan. We manage payroll tax payments and filings for you—guaranteed to be on time and accurate.

These superior options, like whispers of a forgotten track, promise to ease the burden and harmonize the chaotic dance of wages, taxes, and advantages. A flowchart can help on this process, providing a visible illustration of the steps concerned in diagnosing and resolving payroll processing points. The flowchart beneath illustrates a simplified model of the troubleshooting course of. Payroll reporting in QuickBooks Enhanced Payroll 2025 is a multifaceted process https://www.quickbooks-payroll.org/, mirroring the intricate nature of compensation and tax obligations. The software program provides a range of pre-designed reviews, each offering a selected lens through which to view the monetary well being of your payroll. These reviews are easily accessible, customizable, and readily exportable for additional analysis or submission to regulatory bodies.

Frequently Asked Questions (faqs) About Quickbooks Enhanced Payroll 2025

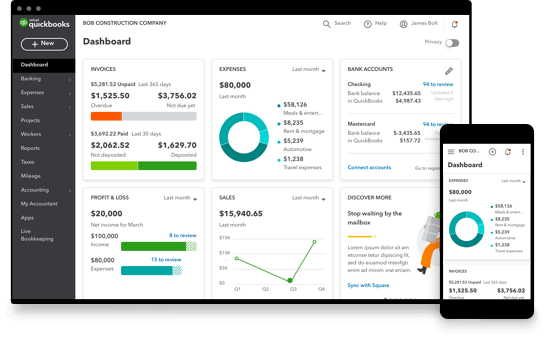

The tax penalty protection program protects your losses occurring as a result of phrases and situations mentioned within the policy. For international payroll necessities, you might need to explore further software options. QuickBooks offers numerous support choices, including on-line help articles, neighborhood boards, and direct customer service contact for extra advanced points. Generate comprehensive reviews that provide insights into labor prices and other financial metrics. When considering a payroll service, reliability and ease of use must be at the high of your record. Enhanced Payroll stands out by integrating effortlessly with QuickBooks Desktop, giving users a unified platform to handle both funds and payroll.

Quickbooks Bank Reconciliation Guide – Simplified For Intuit Users

For the Customers of the accounting program, QuickBooks Desktop has further decisions that are managing payroll. We define QuickBooks On-line Payroll as a cloud-based different associated to the QuickBooks Desktop Payroll in case you’re looking for it. QuickBooks will take care of all the tax funds and tax kind submissions which incorporates the reviews of the end 12 months. It is essential for small enterprise homeowners who want to outsource payroll tax administration.

- The firm file is the core of your payroll system, storing essential employee details similar to wage info, tax deductions, advantages, and more.

- Let’s explore how QuickBooks Enterprise can additional streamline your payroll processes and assist your expanding business.

- Cross-referencing is vital, a solemn quest, to catch discrepancies, put doubts to rest.

- These resources present a safety web, making certain that customers are not left alone to grapple with technical difficulties.

Additional, time will get tracked and timesheets approved by way of this function in QB. Both QuickBooks Desktop and QuickBooks On-line offer QuickBooks Payroll Subscription packages. We’ll briefly discuss every sort so you can get insights into the incredible world of QuickBooks Payroll. Intuit often presents trial periods for his or her merchandise, so it’s worth checking their official website or contacting gross sales to see if a trial is on the market. Share your experiences with QuickBooks, contributing to the continual enchancment of their products. Always learn the terms and circumstances to ensure you’re getting one of the best deal.

The meticulous monitoring of worker hours and leave is crucial for accurate payroll processing and compliance. QuickBooks Enhanced Payroll 2025 offers robust tools for managing this critical facet of payroll administration. The system permits for the recording of both common and extra time hours, as properly as varied types of depart, similar to sick depart, vacation time, and family go away. This detailed tracking ensures that workers are compensated precisely and that the enterprise remains compliant with all relevant labor legal guidelines.

This shift will undoubtedly impact the roles of payroll professionals, demanding adaptation and a concentrate on higher-level strategic tasks. Managing person access and permissions is a crucial quickbooks payroll enhanced aspect of data security. QuickBooks Enhanced Payroll 2025 offers granular control over who can entry what information, limiting entry to only these with a legitimate need to know.

The coronary heart of this method beats in sync with the rhythm of tax regulations. QuickBooks Enhanced Payroll 2025 routinely calculates federal, state, and local taxes, removing the burden of guide calculations. It stays abreast of modifications in tax legal guidelines, guaranteeing compliance and minimizing the chance of penalties. The software program seamlessly integrates with tax businesses, simplifying the process of submitting tax returns and payments. This automated approach considerably reduces the danger of errors and the time spent on tedious tax-related duties. The program’s dedication to accurate and timely tax calculations presents a peace of thoughts that is invaluable within the often-stressful world of payroll administration.

Tailor your payroll settings to meet the distinctive wants of your corporation with QuickBooks Payroll. I appreciated the pliability this characteristic offers, allowing you to customise pay schedules, deductions, and advantages. You can create a payroll system that aligns with your small business operations, making certain a smooth and efficient payroll process. This level of customization is ideal for companies with particular payroll necessities.

I discovered this feature incredibly convenient, permitting you to approve payroll, view reviews, and make changes from anyplace. It ensures that you’ve got the flexibility to handle your payroll operations effectively, irrespective of where you’re. Terms, conditions, pricing, particular options, and service and help options subject to change without discover. If you’ve entered any pay history, you want to enter federal and state tax submitting details for closed quarters in this task. QB will be answerable for reviewing all the knowledge and verifying errors. These steps will guarantee your employees’ W2s are accurate at the year-end.